Two of the most necessary documents for taxpayers and tax collectors in India are the Permanent Account Number (PAN) and the Tax Deduction and Collection Account Number (TAN) (TAN).

While PAN is provided to individuals and organizations who have to pay taxes, TAN is for companies and organizations that deduct/collect taxes at the source.

What does "PAN" stand for in India?

PAN stands for Permanent Account Number. It is a unique 10 digit alphanumeric number, issued by The Income Tax Department India. A PAN is issued to Individuals and Entities

What does "TAN" stand for in India?

TAN stands for Tax Deduction and Collection Account Number. It is a unique 10 digit alpha numeric number allotted by the Income Tax Department (ITD) of India.

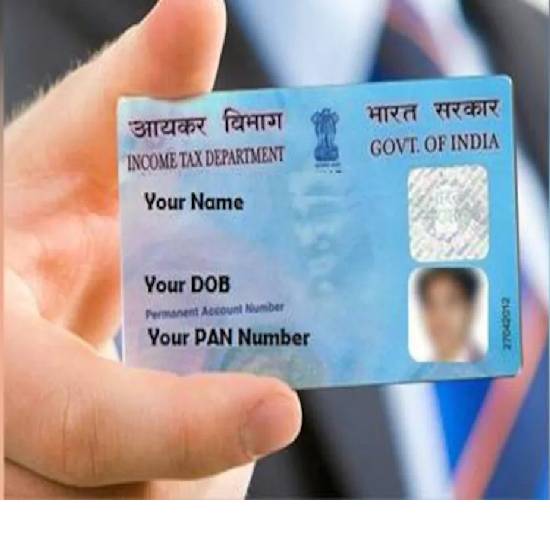

What is a PAN card?

Permanent Account Number, abbreviated as PAN, is a ten-character alphanumeric code. The Income Tax Department issues it to assess who applies in the specified format. The account number is unique to each assessee and has lifetime validity throughout the nation.

The taxation department issues it in the form of a plastic card that serves as an identifier and connects all of the assessee's financial dealings with the department, such as tax payment, refund, TDS or TCS credit, and so on.

PAN aims to connect various documents about the assessee's evaluation, payment, and arrears of taxes to provide easy access to information, thus broadening the tax base and reducing tax evasion. It is mandatory to include your PAN on your income tax return.

Documents Required For PAN Card Registration

The documents required for PAN card registration are mentioned below:

- 2 Passport size Photographs

- Proof of Residential Address

- Identity Proof (such as Aadhaar Card or Voter Id Card, Driving License and Passport)

- Date of Birth

- Valid Mobile Number

How To Register For a PAN Card?

To register for a PAN card, follow the steps mentioned below:

- Firstly visit the NSDL's official online portal for PAN application.

- Choose an application type and a category.

- Enter the required applicant information and press the 'Submit' button.

- Then, upload the necessary documents.

- Finally, you must pay the application fee.

- After successfully submitting the form, you will be given an acknowledgement number, which you will use to track the application.

What is a TAN card?

The Tax Deduction and Collection Account Number (TAN) is a unique alphanumeric code assigned by the Income Tax Department to any individual who is required to deduct or collect tax at the source. It is a ten-digit number that must be quoted when filing a TDS/TCS return or interacting with the income tax department about TDS/TCS.

The deductor pays an Rs. 10000 penalty if the TAN is not applied for or is not quoted in the applicable documents or forms. Individuals, Hindu Undivided Families, Companies, Local Authorities, Partnership Firms, Autonomous Bodies, and other legal entities are all eligible to apply for TAN.

Documents Required For TAN Card Registration

There is no need to provide any documents with the application for TAN allotment. However, if the application is submitted digitally, the acknowledgement provided after completing Form 49B must be forwarded to NSDL.

How To Register For a TAN Card?

To register for a TAN card, follow the steps mentioned below:

- To apply for TAN, go to the NSDL portal and go to the TAN application tab.

- Then, select 'Online Application for TAN (Form 49B)'.

- Select the deductors category from the drop-down menu, then press the 'Select’ button.

- Fill out the form with all of the necessary information.

- Finally, an acknowledgement slip will be produced after the payment is made.

- Keep this acknowledgement slip.

Difference Between PAN Card and TAN Card:

Let’s discuss some of the significant differences between a PAN card and a TAN card:

- PAN is a unique identification number given to any taxpayer, Income Tax Department, who engages in financial activity above a specific threshold limit. On the other hand, TAN is a unique identification number allocated to organisations responsible for deducting or collecting tax at the source.

- To apply for a Permanent Account Number, a person or organization must send Form 49A for Indians and Form 49AA for foreigners. Form 49B, on the other hand, can be used to apply for a Tax Deduction and Collection Account Number.

- Section 139A of the Income-tax Act of 1961 assigns the assessee a PAN number. In contrast, the income tax department assigns TAN numbers under Section 203A of the Income-tax Act of 1961.

- When preparing and submitting an income tax return, you must provide your PAN number. In contrast, a TAN number is required for organizations required to deduct tax from amounts charged or payable under the Income Tax Act.

- Concerning the income tax department, the PAN card acts as a common identification for all financial transactions. On the other hand, the TAN number is used to provide TDS information obtained by any organization.

Wrapping It Up

PAN is not only used for income tax purposes, but it also serves as one of the primary proof of identification. It also helps in the prevention of tax evasion by documenting all monetary transactions. However, PAN cannot be used to obtain TAN since a deductor must obtain TAN even though he has PAN.

However, in the tax deducted at source on the purchase of land and buildings under section 194A, the deductor is not required to have TAN and therefore use PAN for TDS remission.